With scorching temperatures sweeping the U.S. and millions seeking reprieve at nearby beaches, lakes and pools, sun protection is top-of-mind for many Americans. A revealing new study by Veylinx, a leading behavioral research company, sheds light on consumer SPF preferences, emerging skincare trends, and how much consumers are willing to pay for sunscreen—with a growing fear of sun exposure driving much of this behavior.

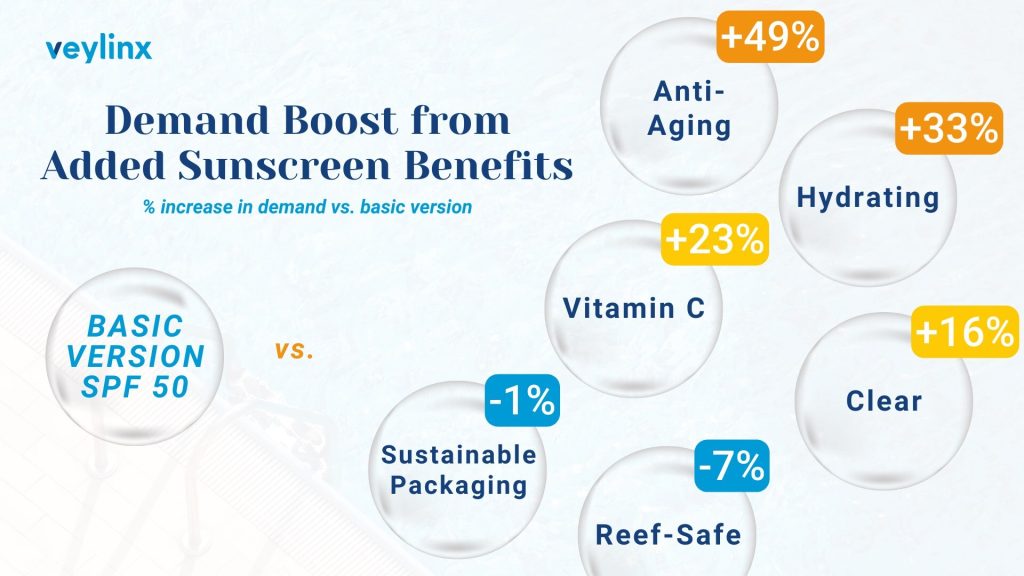

Veylinx tested consumer preferences and willingness to pay for basic versions of popular sunscreen brands compared to conceptual versions enhanced with new benefits. The findings underscore a growing consumer awareness of sun protection benefits and a demand for sunscreen products that offer more than basic UV defense. Products with anti-aging benefits drive a 49% increase in demand, followed by hydrating products (+33%) and those with vitamin C (+23%). Not only do these benefits boost demand, but consumers are willing to pay more for them, too.

Sun Safety Attitudes & “Sunxiety”

The study reveals that while 71% cherish moments in the sun, 38% of people never feel fully relaxed when they’re in the sun. More than 60% report burning very easily and 41% express concern about skin damage. According to a recent Google Trends report, searches for “what does skin cancer look like” have reached unprecedented levels. These insights point to an increase in anxiety around sun exposure and a need for ongoing consumer education on the risks of UV exposure and the benefits of consistent sunscreen use.

Top Performing Sunscreen Brands & Benefits

Top Performing Sunscreen Brands & Benefits

A comparison of the brands tested showed overall preference for Neutrogena (41%), followed by Cerave (38%), Coppertone (35%), Olay (33%), Supergoop (17%) and Target’s Up & Up brand (14%). Supergoop with hydrating benefits drove the highest price point, while anti-aging products from Supergoop, Cerave, and Olay saw the greatest increase in demand over the basic version. A notable 27% of consumers choose reef-safe sunscreens and those interested in these products are willing to pay 14% more—making “reef-safe” a potentially significant revenue driver for brands. Although this indicates a more marine-conscious consumer, only 16% choose sustainable packaging where available — and they are unwilling to pay more for it.

Consumer Sunscreen Usage

The study’s findings reveal an encouraging usage trend, with 30% of respondents applying sunscreen daily during summer and another 21% applying it 5 or 6 times weekly. Additionally, 65% of consumers prefer sunscreens with a SPF greater than 40, reflecting strong demand for higher protection levels. However, only 27% use sunscreen year-round, and 32% apply it only on sunny summer days, suggesting a need for continued education on year-round sun safety. Friends and family (42%) have the greatest influence when it comes to learning about new sunscreen products, followed by social media (35%). And when it comes to protecting their children, 29% of parents use a different sunscreen for their kids.

Market Potential for Beauty Brands

The study identifies a market opportunity for brands that combine sun protection with other products. Fifty-seven percent of respondents choose moisturizers with built-in SPF, and nearly three-quarters prefer using tinted foundation with sun protection. Additionally, clear sunscreens formulated to avoid leaving a white cast were found to boost demand by 16% compared to conventional lotions and creams.